Complexity is hard to predict.

When we think about what will happen in the future, we often think about static systems rather than dynamic systems. That is, we think about what will happen in the future given the reality we experience today, not the actual state of things in the future. Imagine, for instance, living in the year 1900 but trying to predict what life will be like in the year 2000. That was before airplanes, cars, TVs, and the internet.

In a famous paper published in 1974, economist Robert Lucas argued that much economic modeling suffers from this lack of foresight, which is ultimately a lack of appreciating the ever-changing nature of complex systems. “If the consumer knows of the policy change in advance,” he wrote, “it is clear that this standard method gives incorrect forecasts.”

His argument has since become known as the Lucas critique, and it applies to much of our thinking today. It’s interesting to note that the future changes not only based on our changing reality today, but it also changes on our expectations of a future reality based on news we receive today.

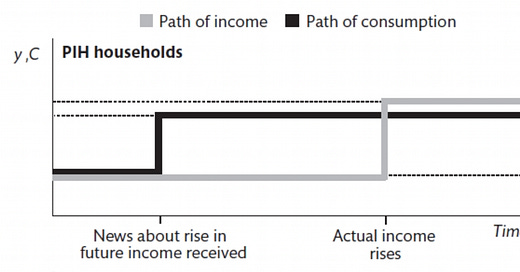

A simple way to think about this dynamic can be summarized in the “permanent income hypothesis” in economics. Imagine your boss told you today that you’ll receive a 20% raise in one month. How would your spending change today? For most people, they would spend and plan their lives now as if that money is already there, even though the money won’t hit their accounts for another month.

Milton Friedman popularized this dynamic back in the 1950s, but it illustrates a larger point about systems and human decision making. This graphic visualizes the chain of events.

The larger point is that the world we live in is full of complex systems that change based on changing conditions, shocks, and feedback loops. Many predictions about complex phenomena, however, fail to take these changes into account, whether related to climate change, taxes, or other policy issues.

One reader responded to my last newsletter, “The sin of statistics,” with an article that noted the difference between something that’s complex and something that’s merely complicated, and that summarized things well enough. The organization that published the article is focused on urban planning and development. It seeks, among other goals, to “shift the priority of local streets from automobile throughput to human safety and wealth creation.” That caught my attention.

A popular ridesharing platform has a similar goal of seeing a future “where cities are designed for people instead of cars.” The company believes “we are about to witness the largest change to our cities and physical environment in a generation—less traffic, more pedestrian areas, more bike lanes.”

I won’t pretend to know a lot about urban development. But I do wonder what will happen to these urban areas if car traffic were greatly reduced. Economist Thomas Sowell once argued that local businesses are negatively impacted because overall traffic—pedestrian and car traffic—is reduced. Local businesses have long made the same argument, but some research suggests that results are mixed.

It’s easy to look at data and make predictions about how much better the world would be if X or Y happened. Over 6,400 pedestrians were killed in 2020. But does it matter that 45% involved high blood-alcohol concentration? Or that over 73% were killed when it was dark? Or that 70% of the victims were male? Perhaps these details are unimportant, but perhaps there’s more to the system of pedestrian safety than just cars vs. no cars.

It’s much more difficult, however, to make predictions that account for how factors change based on our policies. Perhaps increasing walkable streets or reducing parking lots will cause people to go elsewhere to shop in a center with easier parking or a shorter walk to the restaurant. Perhaps it reduces elderly foot traffic or pedestrians with physical disabilities because it’s much more difficult to get where they want to go. These kinds of calculations are impossible to make ahead of time.

Another story like this caught my eye last week.

Gun buyback programs are politically popular, especially after a spike in violence, because the logic is simple. Guns on street? Buy them back. Now less guns on street. Except that rational economic actors change the rules of the game based on the changing rules of the game. One Houston man 3D-printed guns and made a few thousand dollars from the program. Another woman sold her gun only to upgrade for another later, a common response to such programs. The result is government-subsidized improvements in firearms. This outcome is not only the exact opposite of its intention, it’s also impossible to accurately predict.

I’m currently reading a book called Unsettled that discusses the complexity of large computer models and their predictions as it relates to climate change. Steve Koonin is a physicist who has worked for decades with computer models like those used to model the climate and predict its effects. He was also the undersecretary for energy during the Obama administration. A major thesis of the book is that these predictions aren’t as “settled” as we think, partly due to the assumptions and variabilities within the models themselves, and partly due to the fact that we have no idea what society will look like fifty or a hundred years from now. You can read a summary of his critique in The Wall Street Journal, where he’s written several op-eds, like this one.

My hope is that by better respecting complex systems and the unpredictable nature of their interactions, I’ll be able to better predict where others’ predictions will go awry. I hope it’ll also help me ask better questions, and mix in a little more humility with my judgments.